Your Periodic system income statement images are available. Periodic system income statement are a topic that is being searched for and liked by netizens today. You can Find and Download the Periodic system income statement files here. Download all free images.

If you’re searching for periodic system income statement images information connected with to the periodic system income statement interest, you have come to the ideal blog. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

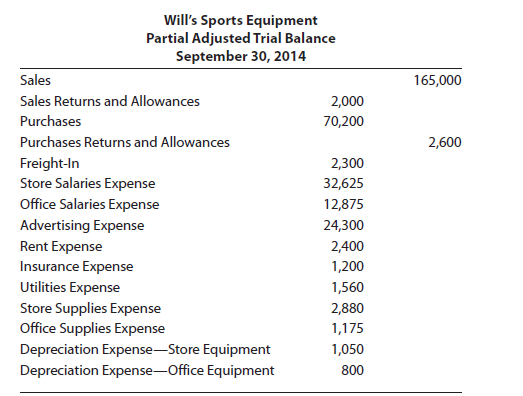

Periodic System Income Statement. Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method. Periodic means that the Inventory account is not updated during the accounting period. This is an example of how to create a partial income statement for a merchandising company.

Inventory And Cost Of Goods Sold Explanation Accountingcoach From accountingcoach.com

Inventory And Cost Of Goods Sold Explanation Accountingcoach From accountingcoach.com

Partial income statement periodic system. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased. A purchase return or allowance under perpetual inventory systems updates Merchandise Inventory for any decreased cost. The yearly inventory purchases are recorded in the purchases account which is a ledger listing all inventory purchases and their costs. Gross margin Net sales Cost of goods sold. Their balances are transferred to the income summary.

When preparing closing entries under the periodic inventory.

Income statement example periodic inventory system. For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes. Otherwise the steps are the same. J Cansfield GRADE 12 INVENTORY SYSTEM NOTES Page 4 of 4 FINANCIAL STATEMENTS FOR PERIODIC INVENTORY SYSTEM Income Statement _____ Income Statement for. In a period system you will have to do some calculations to compute cost of goods sold. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method.

Source: accountingcoach.com

Source: accountingcoach.com

For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes. The yearly inventory purchases are recorded in the purchases account which is a ledger listing all inventory purchases and their costs. At the end of the year a physical inventory count is done to determine the ending inventory balance and the cost of goods sold. Beginning inventory Purchases Cost of goods available for sale Cost of goods available for sale Ending inventory Cost of goods sold. Under the periodic system an entry must be made in the Merchandize Inventory account to adjust this balance to the amount of inventory counted and valued at year-end.

Source: pinterest.com

Source: pinterest.com

At the end of the accounting year the Inventory account is adjusted to the cost of the merchandise that is unsold. Under a periodic inventory system Purchases will be updated while Merchandise Inventory will remain unchanged until the company counts and verifies its inventory balance. At the end of the year a physical inventory count is done to determine the ending inventory balance and the cost of goods sold. In a period system you will have to do some calculations to compute cost of goods sold. 75 OFF the Full Crash Course on Udemy.

Source: accountingcoach.com

Source: accountingcoach.com

The gross initial margin width can glimpse a company back they schedule a significant initial margin after sales revenue through cost both are computed to cover operational costs and profit goals. This statement breaks out costs into product and period costs. Httpbitly2oZIdcPIn this tutorial I go on to talk more about how purchases discounts freight and all other tran. Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated. J Cansfield GRADE 12 INVENTORY SYSTEM NOTES Page 4 of 4 FINANCIAL STATEMENTS FOR PERIODIC INVENTORY SYSTEM Income Statement _____ Income Statement for.

Source: pinterest.com

Source: pinterest.com

The products in the ending inventory are either leftover from the beginning inventory or those the company purchased. At the end of the year a physical inventory count is done to determine the ending inventory balance and the cost of goods sold. How a periodic inventory system works because the physical accounting for all goods and products in stock is so time consuming most companies conduct them sparingly which often means once a year or maybe up to three or four times per year. Gross margin Net sales Cost of goods sold. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method.

Source: pinterest.com

Source: pinterest.com

If you are working with a company that uses a perpetual inventory system cost of goods sold will already be computed for you. The cost of goods sold commonly referred to as COGS is a fundamental income statement account but a company using a periodic inventory system will not know the amount for its accounting records. The gross initial margin width can glimpse a company back they schedule a significant initial margin after sales revenue through cost both are computed to cover operational costs and profit goals. The Income Statement is one of a companys core financial statements that shows their profit and loss Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a over a period of time. Under the periodic inventory system the Merchandise Inventory account appears in the closing entries made at the end of the period.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

A periodic system does allow a company to control costs by keeping track of the individual inventory costs as. Under the periodic inventory system the cost of goods sold. A purchase return or allowance under perpetual inventory systems updates Merchandise Inventory for any decreased cost. This count and verification typically occur at the end of the annual accounting period which is often on December 31 of the year. For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes.

Source: pinterest.com

Source: pinterest.com

The Merchandise Inventory account balance is reported on the balance sheet. If you are working with a company that uses a perpetual inventory system cost of goods sold will already be computed for you. A periodic system is cheaper to operate because no attempt is made to monitor inventory balances in total or individually until financial statements are to be prepared. Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated. A periodic system does allow a company to control costs by keeping track of the individual inventory costs as.

Source: accountingcoach.com

Source: accountingcoach.com

However the inventory amounts for the monthly and quarterly financial statements are usually estimates. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased. Httpbitly2oZIdcPIn this tutorial I go on to talk more about how purchases discounts freight and all other tran. Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated. How a periodic inventory system works because the physical accounting for all goods and products in stock is so time consuming most companies conduct them sparingly which often means once a year or maybe up to three or four times per year.

Source: pinterest.com

Source: pinterest.com

At the end of the accounting year the Inventory account is adjusted to the cost of the merchandise that is unsold. LIFO means last-in first-out and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. Computing the Inventory Amount Under the Periodic Inventory Method. Partial income statement periodic system. These financial statements are prepared the same way under either the perpetual or periodic inventory methods.

Source: pinterest.com

Source: pinterest.com

Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated. When creating the income statement for a merchandising company it is important to break costs out into product costs and period costs. Net sales Sales revenue Sales discounts Sales returns and allowances. This is an example of how to create a partial income statement for a merchandising company. Under periodic inventory systems a temporary account Purchase Returns and Allowances is updated.

Source: accountingcoach.com

Source: accountingcoach.com

This count and verification typically occur at the end of the annual accounting period which is often on December 31 of the year. Instead the cost of merchandise purchased from suppliers is debited to the general ledger account Purchases. At the end of the accounting year the Inventory account is adjusted to the cost of the merchandise that is unsold. In a periodic inventory system no continuous record of changes is kept. The calculation of the cost of goods sold under the periodic inventory system is.

Source: pinterest.com

Source: pinterest.com

LIFO means last-in first-out and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. This statement breaks out costs into product and period costs. J Cansfield GRADE 12 INVENTORY SYSTEM NOTES Page 4 of 4 FINANCIAL STATEMENTS FOR PERIODIC INVENTORY SYSTEM Income Statement _____ Income Statement for. For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes. Under the periodic inventory system the Merchandise Inventory account appears in the closing entries made at the end of the period.

Source: accountinginfocus.com

Source: accountinginfocus.com

Beginning inventory Purchases Cost of goods available for sale Cost of goods available for sale Ending inventory Cost of goods sold. In a period system you will have to do some calculations to compute cost of goods sold. The Income Statement is one of a companys core financial statements that shows their profit and loss Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a over a period of time. However the inventory amounts for the monthly and quarterly financial statements are usually estimates. Periodic means that the Inventory account is not updated during the accounting period.

Source: chegg.com

Source: chegg.com

The Income Statement is one of a companys core financial statements that shows their profit and loss Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a over a period of time. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method. Instead the cost of merchandise purchased from suppliers is debited to the general ledger account Purchases. The Merchandise Inventory account balance is reported on the balance sheet. Partial income statement periodic system.

Source: pinterest.com

Source: pinterest.com

If you are working with a company that uses a perpetual inventory system cost of goods sold will already be computed for you. However the inventory amounts for the monthly and quarterly financial statements are usually estimates. 75 OFF the Full Crash Course on Udemy. Their balances are transferred to the income summary. Gross margin Net sales Cost of goods sold.

Source: in.pinterest.com

Source: in.pinterest.com

Partial income statement periodic system. The Cost of Goods Sold is reported on the Income Statement under the perpetual inventory method. Otherwise the steps are the same. All income statement accounts with credit balances are debited to bring them to zero. The Merchandise Inventory account balance is reported on the balance sheet.

Source: pinterest.com

Source: pinterest.com

Periodic means that the Inventory account is not updated during the accounting period. Beginning inventory Purchases Cost of goods available for sale Cost of goods available for sale Ending inventory Cost of goods sold. For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes. The yearly inventory purchases are recorded in the purchases account which is a ledger listing all inventory purchases and their costs. The remainder of the cost of goods available is reported on the.

Source: pinterest.com

Source: pinterest.com

Gross margin Net sales Cost of goods sold. In a periodic inventory system no continuous record of changes is kept. Instructions on how to create the gross profit section of an partial income. These financial statements are prepared the same way under either the perpetual or periodic inventory methods. Under the periodic inventory system the cost of goods sold.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title periodic system income statement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.